The adoption of digital wallets and payment apps was rising long before the pandemic got people stepping away from cash to conduct transactions at a safe distance. In the US, the use of mobile wallets has gone up by an additional 50% from 2020 to 2021.

This growth is accompanied by increasing competition in the mobile payment space and features that a digital wallet enables like easy onboarding, fair rates, payment analytics, bill payments, and seamless P2P transfers.

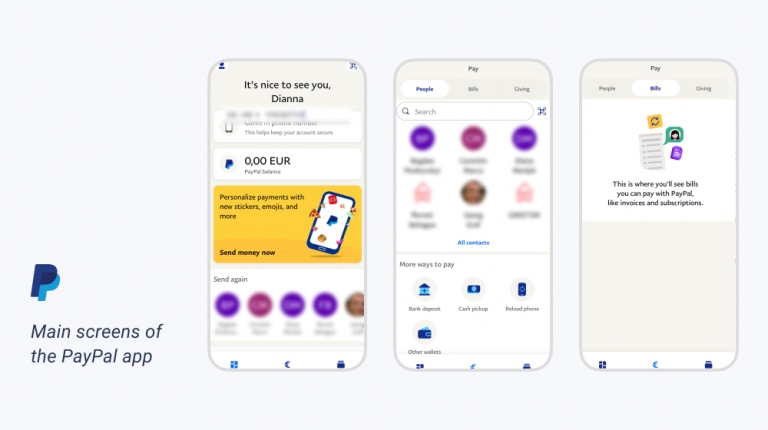

Customers want the security of their local bank, with the convenience of shopping on Amazon. Smooth transactions, clear messaging, and seamless journey flows are key to creating a sense of security that users expect from a financial app.

In the digital payment space, there are two undeniable heavyweight champions: PayPal and Wise. In our UX app analysis, we compare both apps (TransferWise vs Paypal) so you can learn from the value drivers and missed opportunities of each.

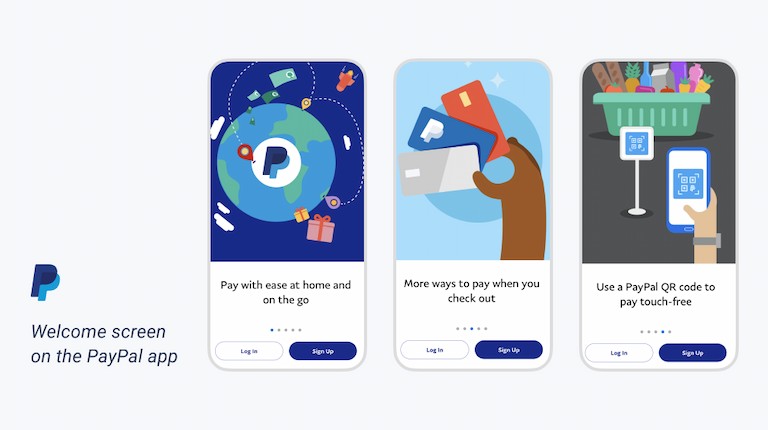

PayPal is undeniably the OG of mobile payment, having launched over two decades ago with nearly 300 million customers to date. Besides making it easier to split checks at the table, PayPal gives people the ability to accept payment online quickly and securely without having to use a credit card.

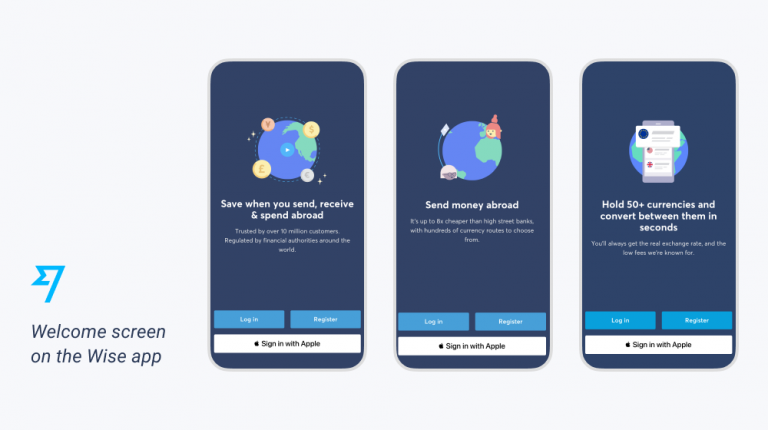

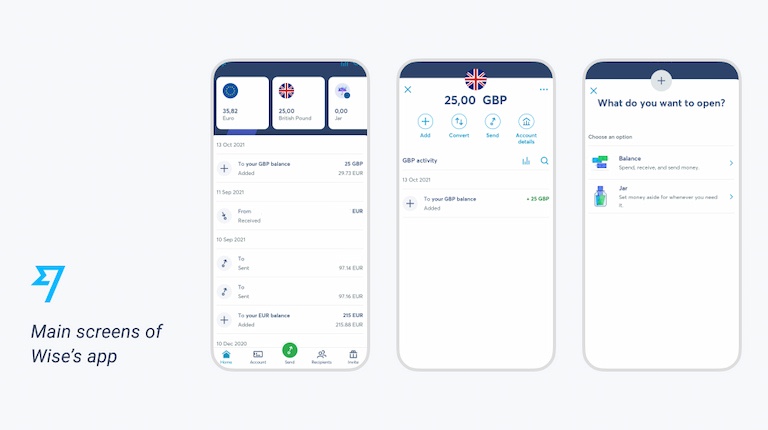

Wise (formerly TransferWise), PayPal’s biggest competitor with over 9 million customers, is known for affordable cross-border money transfers. As soon as they hit the market, Wise quickly attracted swashes of users with low-cost and transparent pricing since traditional bank wires were (and still are) expensive.

One thing’s clear: Fintech apps need to instill trust. They need to be held to the highest security standards, but they also need to feel secure to the users.

The design of each UI and user flow will be key to creating this sense of security that users expect from a financial app. One slip and the trust is broken — leading to app abandonment.

App onboarding, creating an account, usability, and making payments are some of the many topics we cover. To access the full UX app analysis, download your copy by clicking on the following button or image:

More app analyses:

AUTHOR

Elena Prokopets

Elena is a freelance content writer for tech-led companies, prioritizing great content and stellar customer experience above all.

What’s UXCam?

Related articles

UX design

Auditoria de UX – Como Realizar uma (Etapas, Modelos e Checklist)

Navegue por auditorias de UX com facilidade usando nosso guia para iniciantes, com instruções passo a passo, modelos personalizáveis e um checklist...

Tope Longe

Growth Marketing Manager

UX design

UX Audit - How to Conduct One (Steps, Templates & Checklist)

Navigate UX audits effortlessly with our beginner's guide, offering step-by-step instructions, customizable templates, and a detailed...

Tope Longe

Growth Marketing Manager

UX design

12 UX Metrics to Measure and Enhance User Experience

Unlock product success by tracking the right UX metrics. Learn 12 essential metrics, how to measure them, avoid common pitfalls, and take action with tools like...