Back to blog

6 MIN READ

Finance Product Management - An In-Depth Guide

PUBLISHED

21 April, 2024

Product Analytics Expert

If you’ve ever closed an app in a fit of rage, you can recognize the value of finance product management.

For finance apps, a smooth UX is non-negotiable. When customers entrust you with their money, they expect a quality experience.

Despite this demand, a significant portion of finance apps fail to meet expectations, often lacking the intuitive user experience (UX) crucial for customer satisfaction and engagement. In fact, 53% of finance app users who abandoned apps did so because they found other apps that better met their needs.

There’s a silver lining to this, though. If you bridge the gap between user needs and app functionality, you’ll have a formula for a winning app. That is precisely the job of UX designers and product managers.

At UXCam, we understand that product managers play an important role in a finance app’s success story. As such, this article will explore how leveraging mobile analytics platforms like UXCam can bring your product to unprecedented levels of user engagement.

Helpful summary

Overview: We emphasize the importance of user experience (UX) in finance app development, acknowledging that a significant number of finance apps fail due to poor UX.

Why It Matters: Gathering insights into user experience is paramount in the finance sector. Enhanced UX leads to higher customer satisfaction and engagement, which reduces the chances of users abandoning your app.

Action Points: By leveraging UXCam's analytics suite, you can increase your insights into user behavior.

Further Research: To complement learning and ensure the development of a user-centric finance app, continue exploring advanced analytics tools and UX best practices.

Why listen to us?

Navigating the complexities of finance product management demands a unique blend of user-centric design and deep analytical insight. We've directly tackled these challenges, providing solutions that significantly enhance user engagement and operational efficiency. Our work with Costa Coffee and Housing.com through UXCam showcases our expertise.

Using our app, product managers have overcome major challenges in UX design. Our analytical insight has helped significantly enhance user engagement and operational efficiency.

Costa Coffee harnessed session recordings and analytics to reduce app registration drop-offs by identifying and rectifying a major pain point in their process, leading to a 15% increase in user registrations.

What is finance product management?

Finance product management refers to the specialized field of product management that creates and manages financial products.

Think of it as a bridge between traditional financial services and innovative solutions in the rapidly advancing Fintech universe, whether it's for banking institutions, Fintech startups, investment platforms, or insurance firms.

What does a product finance manager do?

At its core, finance product management oversees and improves the life cycle of financial products and services. This includes everything from the initial stages of product development, where ideas are transformed into tangible solutions, through to their final launch into the market.

As a finance product manager, you need to understand customer needs, analyze the competitive landscape, incorporate regulatory considerations, craft a strategic direction, and work collaboratively with diverse teams of engineers, marketers, sales, and other stakeholders.

Finance product management also brings together insights from advanced analytics to enable data-driven decision-making to drive product success. From identifying key performance drivers to monitoring post-launch product performance, detailed experience analytics for tools like UXCam are important.

It is through this intricate combination of financial knowledge, strategic planning, project management, and data analysis that finance product managers drive product growth and profitability.

Role of data analytics in Finance Product Management

Traditional thinking would lead you to believe that a finance app is merely a tool to check bank balances or make payments.

When we say “finance app”, we're envisioning a personal finance coach, a secure financial vault, a travel companion, and a tech-savvy BFF all wrapped into one mobile interface.

Your challenge? Balancing these elements to create a unique, yet functional app.

Finance product management requires the finesse of a designer coupled with the sharp insights of a data wizard.

You should be able to make bold decisions, but they must be grounded in usage analytics. Dozens of analytics come into play.

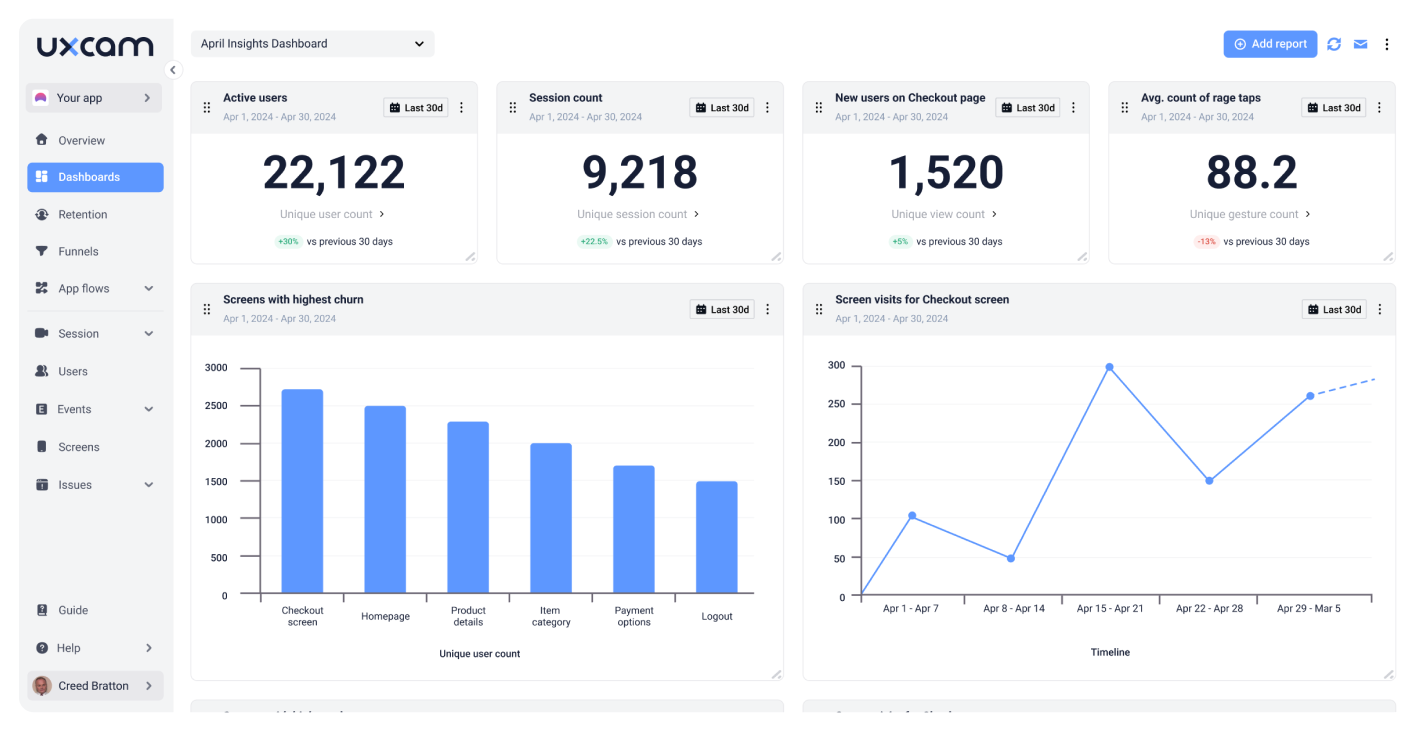

When you’re planning finance product management, you should draw on UXCam, a user experience analytics solution for mobile apps. We offer tools like Session Replay, Heatmaps, Funnel Analytics, and Quantitative Analytics. With this toolkit at their disposal, managers can make impactful decisions.

What is the value of product management in finance?

Improve your product strategically

To be a product manager, you need to be a scientist. Question everything.

Get to the bottom of every user interaction with granular data. Then, form a strategy based on your findings. For instance, you might need to simplify a core process in your application if the data tells you it’s too complex.

Using a tool like UXCam, you can uncover the data you need to see the bigger picture.

Create user-centric features

The best way to increase customer loyalty and retention is to find out what your users think. The product management process should review where important events happen in your app. By examining these details, you can figure out which new features to roll out.

Iterate quicker

With real-time data collection and analysis, the speed at which product managers can iterate on their app's UX is vastly accelerated. This is crucial in an environment where changes can directly impact the user's financial health and decisions

Strategies for Financial product management

1. Launching products and features

Creating, testing, and introducing new systems and products will shape user experience and satisfaction. By observing how users interact with the app in real time, you can make adjustments before the full launch, ensuring the product is primed for success.

With UXCam, finance product managers can gain invaluable insights into user behaviors during these early stages. These insights will help you design intuitive and user-friendly interfaces, simplifying complex financial transactions and processes.

UXCam offers a comprehensive tool for mobile apps that provides event analytics and to see how users experience your app. Users can tag sessions, filter for issues like rage taps or unresponsive tap heatmaps, identify drop-off points in the funnel, and manually review sessions within the dashboard.

This detailed level of insight enables professionals to form hypotheses and make informed decisions for conversion rate optimization (CRO). UXCam integrates with various platforms, including Native Android, Native iOS, Flutter, React Native, Cordova, Xamarin, Nativescript, and more.

By combining qualitative data with quantitative results from A/B testing, users can gain a deeper understanding of user behavior and make data-driven decisions to optimize their mobile apps effectively.

2. Monitor and adapt

After a financial product's launch, the work is far from over. Continuous monitoring and adaptation are essential to keep pace with ever-changing user demands.

Here, UXCam's analytics shine by providing a clear view of how users engage with the product. This data is crucial for identifying trends, usability issues, and areas for enhancement, enabling product managers to swiftly adapt their offerings to meet current demands and stay ahead of the curve.

For example, if users are struggling to navigate a certain feature of the app, product managers can use UXCam's session replay feature to identify pain points and make necessary adjustments for a more seamless user experience.

Strategic vision and risk management

Anticipating market changes and identifying potential risks are tasks that require a robust strategic vision and effective risk management. UXCam aids in these areas by offering insights that can predict user behavior patterns and market shifts.

Recognizing potential issues early on, through UXCam’s Autocapture, helps finance product managers mitigate risks before they impact the user experience or the financial product's integrity.

For example, UXCam can pinpoint areas where users are dropping off during a transaction process, allowing product managers to address the issue and prevent any potential loss of revenue.

3. Ensure customer satisfaction

Financial products need to satisfy their customers if they want to succeed. By leveraging UXCam's session replays and heatmaps, product managers can dive deep into the user experience, identifying both friction points and highlights. This understanding is crucial for crafting solutions that not only meet but exceed user expectations, fostering satisfaction and loyalty.

For instance, by analyzing heatmaps, product managers may discover that a particular button is consistently overlooked by users. In this case, making the button more prominent and accessible could improve the user experience and potentially increase customer satisfaction.

4. Work as a team

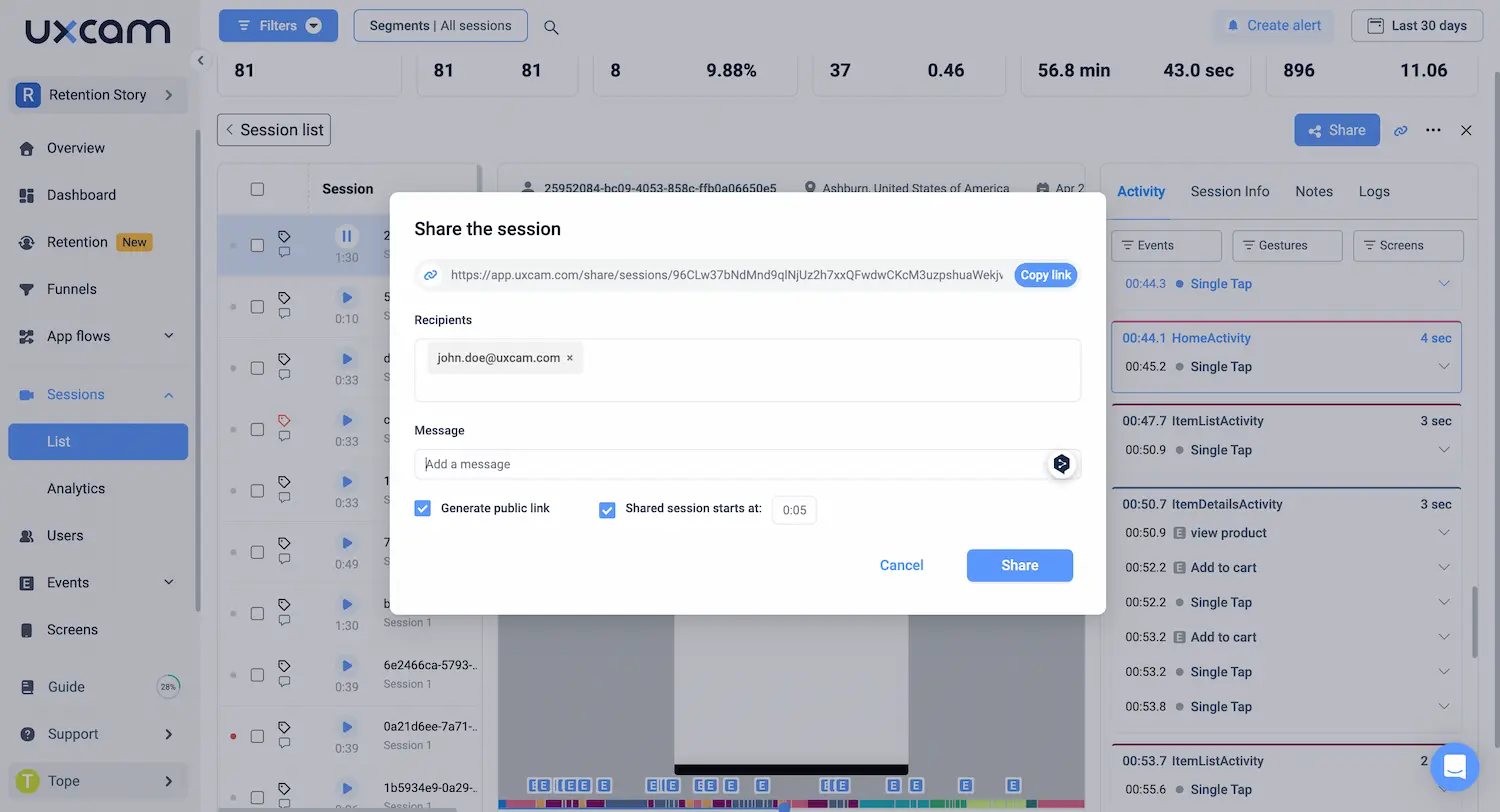

The evolution of a financial product post-launch requires concerted effort and teamwork. UXCam facilitates this by making it easy to share insights and data across teams, ensuring everyone is aligned on the user experience goals and product evolution strategy. This collaboration is the backbone of sustained product improvement and market relevance.

UXCam's collaboration features permit product managers to share session replays and heatmaps with user research teams, enabling them to gather qualitative feedback from users and make data-driven decisions together.

For example, if you need to share a specific session with colleagues who do not have their own UXCam account, simply click on the link icon to automatically copy the session URL.

Alternatively, you can use the Share button, include recipients, add a message, select the relevant section of the session to share, and then click on “Share” to send it automatically from UXCam.

Conclusion and next steps

The critical role UX plays in the financial app landscape is irrefutable. With UXCam, product managers have a microscope to inspect mobile finance apps with unrelenting detail.

Your app’s strategy should be rooted in user experience analytics. Step into the shoes of your clients and see your app through their lens. In doing so, you can build an app that exceeds expectations, ensuring your finance app becomes a leader in its field.

When it comes to managing finance apps, the time for guesswork is over. The time for data-driven, user-centric action is now. Step up your game by signing up with UXCam for free and begin providing the kind of service your customers expect—and deserve.

You might also be interested in these;

Finance apps have a customer support problem, here's how to fix it

7 Ways to increase FinTech app account activation

8 low-effort high-impact fintech mobile app improvements

A practical guide to mobile app product management

12 KPIs to measure and improve your FinTech app onboarding strategy

13 Best product management tools 2024 & when to use them

Ecommerce product management guide for mobile product teams

Go-to-market strategy in product management: guide + checklist

AUTHOR

Tope Longe

Product Analytics Expert

Ardent technophile exploring the world of mobile app product management at UXCam.

What’s UXCam?

Related articles

Session Replay

Mobile Session Recording: Our Complete Guide (+Tools)

Learn what mobile session recording is, why it matters, and the best tools to analyze user behavior. See how UXCam helps improve app and web...

Annemarie Bufe

Product Analytics Expert

Product Management

18 Best Product Development Software for Every Team 2026

Discover the 14 best product development software tools to streamline collaboration, track progress, collect feedback, and build better products...

Tope Longe

Product Analytics Expert

Product Management

13 Best Product Management Tools 2025 & When to Use Them

Find out the top tools that the best product managers use daily to perform better at...

Jane Leung

Product Analytics Expert